Key Changes to Super Contributions for the 2024/25 Financial Year

As we enter the 2024/25 financial year, it’s important to stay informed about the latest updates to superannuation contributions to ensure your financial strategies are aligned with the new rules and contribution caps. Here’s a brief overview of the key changes that may impact your superannuation planning:

1. Personal Deductible Contributions

- Eligibility Criteria: If you are under 67, you can make personal deductible contributions without needing to meet a work test. If you are aged 67 to 74, you must meet the work test to claim a tax deduction, unless you qualify for the work test exemption.

- Work Test Exemption: You may be eligible for an exemption if you met the work test in the previous financial year, have a total super balance below $300,000, and haven’t used this exemption in the past.

- Contribution Caps: Personal deductible contributions count towards your concessional contributions cap. For the 2024/25 financial year, the concessional contributions cap is $30,000. It’s essential to monitor your contributions to avoid exceeding this cap, which includes employer contributions, salary sacrifice contributions, and personal deductible contributions.

2. Non-Concessional Contributions

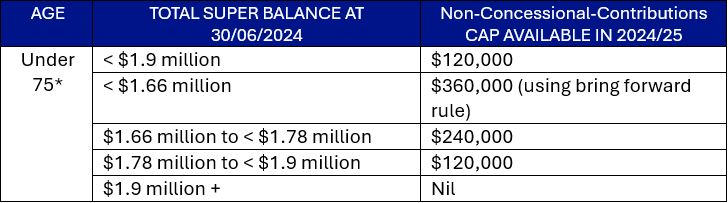

- Eligibility: You can make non-concessional contributions if you are under 75 and your total super balance as of 30 June 2023 is less than $1.9 million.

- Bring-Forward Rule: If you are not already in a bring-forward period, you may be able to bring forward up to three years of non-concessional contributions, depending on your total super balance.

3. Spouse Contributions

- Contribution Rules: No work test is required for your spouse to receive contributions if they are under 75. These contributions count towards your spouse’s non-concessional contributions cap.

- Tax Offset: You could be eligible for a tax offset of up to $540 if your spouse’s income is below $40,000 and you make contributions to their super.

4. Downsizer Contributions

- New Age Limit: The minimum age to make downsizer contributions has been lowered to 55, with no upper age limit.

- Contribution Amount: You can contribute up to $300,000 from the sale proceeds of your main residence. These contributions do not count against other contribution caps.

Next Steps

We encourage you to review your current super contributions and consider how these changes may affect your strategy.

If you have any questions or would like to discuss your specific circumstances, please don’t hesitate to reach out to us. We’re here to help you make the most of your superannuation opportunities.