On 9 October 2025, the Government introduced two Bills to Parliament — the Treasury Laws Amendment (Payday Superannuation) Bill 2025 and the Superannuation Guarantee Charge Amendment Bill 2025. Together, these Bills set out the legislative framework for implementing the Payday Super regime.

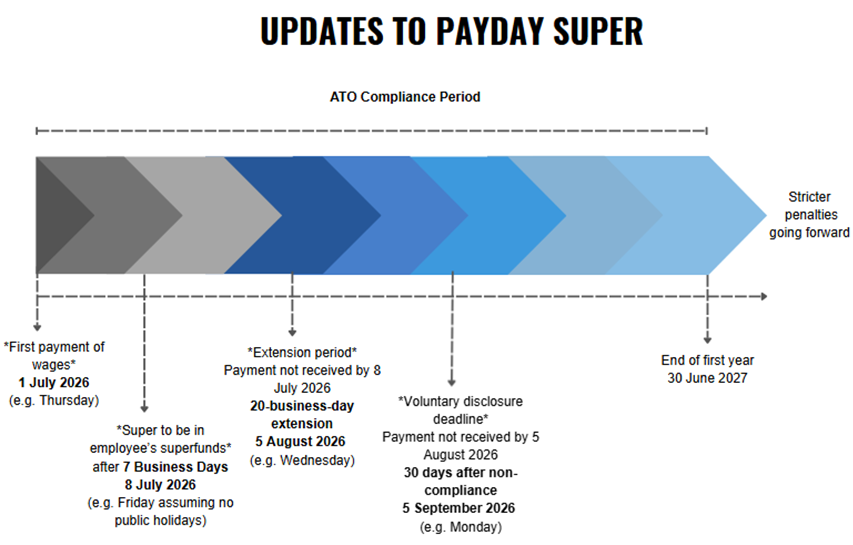

The Payday Superannuation Bill proposes that, from 1 July 2026, employers must pay superannuation at the same time as salary and wages. While the legislation remains open for consultation and has not yet been enacted, its introduction marks a significant milestone in efforts to strengthen the integrity and timeliness of Australia’s superannuation system. Further details and implementation guidance will be released once the Bill has been finalised.

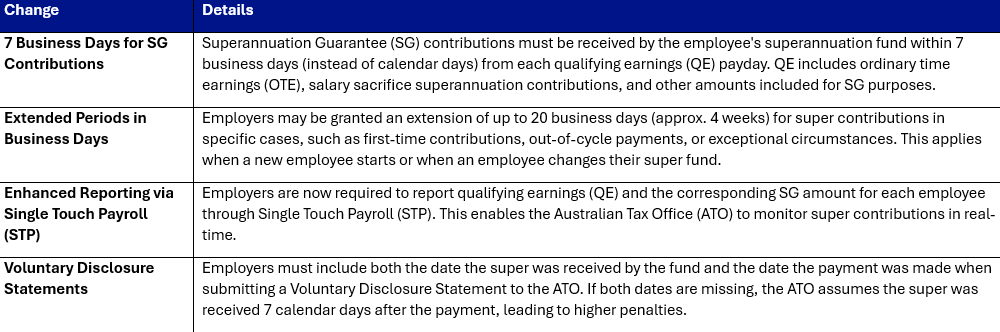

Key Changes to the Draft Legislation

ATO Draft Practical Compliance Guideline PCG 2025/D5 Payday Super – first year ATO compliance approach.

The Australian Taxation Office (ATO) has released a Draft Practical Compliance Guideline PCG 2025/D5 Payday Super – first year ATO compliance approach.

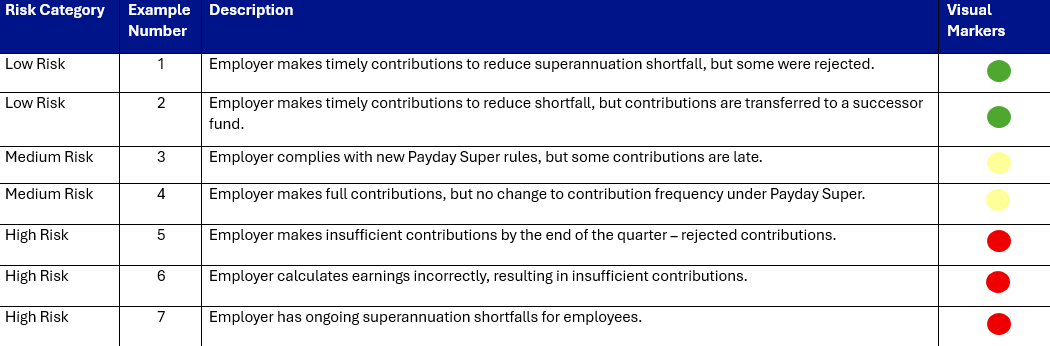

The framework will apply for the period from 1 July 2026 to 30 June 2027, after which stricter penalties are expected to take effect. It establishes a risk-based approach to guide the ATO’s focus areas, with high-risk employers receiving priority attention and medium-risk employers also likely to face review. To be classified as low risk, employers must make contributions on time, promptly correct any errors, and ensure there are no superannuation guarantee shortfalls.

Superannuation Contribution Risk Categories and Examples. Source: ATO Draft Practical Compliance Guideline PCG 2025/D5

Preparing for the Introduction of Payday Super

With Payday Super on the horizon, now is the time for employers to start planning and ensuring their payroll systems and processes are ready. Key areas to review include:

- Payroll systems and Single Touch Payroll (STP) compliance – Confirm your systems are capable of processing super contributions each pay cycle and reporting them correctly under the new STP framework.

- Clearing house and payment arrangements – Check that your clearing house and super remittance processes can accommodate more frequent contribution payments.

- Employee and contractor onboarding – Make sure employee and contractor details are collected accurately during onboarding to prevent contribution errors or rejections.

- Maximum contribution base – For higher-income employees, ensure your payroll settings are adjusted for the change from quarterly to annual assessment.

These steps will help smooth the transition to the new rules and minimise compliance risks.

If you’d like guidance in reviewing your payroll processes or assessing your readiness for Payday Super, please contact our office for support.

Article By Taylah Obst Taylah Obst is an Accountant at 360Private, currently completing her CA studies and recently presented with a second Certificate of Merit from Chartered Accountants Australia and New Zealand for being in the top 5% of candidates in Australia.