Quarterly Investment Update

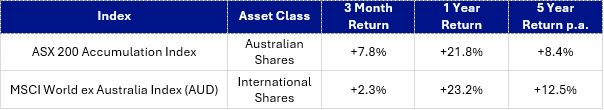

The index returns quoted below are for the period ended 30 September 2024, sourced from Morningstar.

Markets performed very well this quarter with many indices reaching record highs. Some of our key takeaways from this quarter and outlook for the period ahead are summarised below.

- Australian Shares returned +7.8% during the quarter, taking the 1 year return to +21.8% and the 5 year return to +8.4% per annum.

- International Shares returned +2.3% during the quarter, taking the 1 year return to +23.2% and the 5 year return to +12.5% per annum.

- A number of central banks including the US, Canada, New Zealand, England and Europe started to cut interest rates this quarter. Current market pricing implies that the Reserve Bank of Australia’s first rate cut will be in March 2025. Interest rate cuts are generally positive for shares provided that economic conditions remain strong.

- In July, we wrote about the large valuation dispersion between small cap shares and large cap shares. Much of the market’s total return over the last couple of years has been driven by large caps, with small caps lagging behind. The valuation discount began to unwind this quarter. Small caps have historically performed well while interest rates are falling and we remain constructive on the outlook for small cap shares.

- Commodity prices tumbled, particularly iron ore, as the strength of the Chinese property market came into question. This was followed by a sharp recovery as the Chinese government stepped in with interest rate cuts and stimulus to prop up the economy. While we acknowledge that rising and falling commodity prices are part of a functioning economic cycle, this is an area we are watching closely.

- The US presidential election is coming up on November 5th. There may be some individual companies that fare better or worse under a Trump or Harris presidency due to their respective policies, but the election by itself is unlikely to cause any permanent shifts in the overall market.

While we are pleased by the market’s performance over the last year, it’s important to remember that periods of exceptional returns can be followed by phases of moderation. As prudent investors, we believe in maintaining a well-diversified portfolio of high quality assets with sufficient cash to navigate varying market conditions with confidence. We will continue to monitor markets closely and make adjustments to our client’s portfolios as deemed appropriate.