Jul 2024 360Private

Investment & Portfolio

Quarterly Investment Update

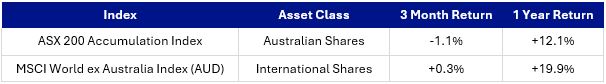

The index returns quoted below are for the period ended 30 June 2024, sourced from Morningstar.

Markets recorded a subdued quarter to round out another pleasing financial year for investment returns. Many global indices continue to trade at or near record highs despite some signs of a slowing economy. Inflation is generally back at more palatable levels and there is the prospect of interest rate cuts in the not-too-distant future. These factors combined with a plethora of major global events on the horizon – perhaps none more so than the upcoming US election – suggests there should be no shortage of dramatic headlines and market-shaping events over the year to come.

Australian shares returned +12.1% for the financial year. The best performing sectors were financials and information technology, while resources and consumer staples were detrimental to the index’s return.

Financials were the shining beacon with a +35% return for the financial year. Financials account for roughly one quarter of the index’s total value, so this was a significant source of the market’s total return. However, this performance was driven entirely by multiple expansion with no contribution from earnings growth. This means that the banks are collectively no more profitable today than they were a year ago, yet the market is willing to now pay 35% more to buy bank shares than this time last year. This type of return is unlikely to be sustainable over the medium to long-term without some growth in earnings. Despite this, given that banks represent a quarter of the index, we believe it’s important to have some bank exposure in a diversified portfolio of Australian shares. Some of the major Australian banks do portray attractive characteristics such as dominant market positions and high barriers to entry. If an investor did not have any bank exposure over the last 12 months, it is probable that their portfolio’s performance would have fallen behind that of the index.

International shares had another great financial year, returning +19.9%. Information technology and communication services were the standout performers on a sector level.

The magnificent seven, a group of companies comprising Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla, were all the rage this year. With the exception of Tesla, which faded in recent months on concerns around falling demand and rising competition, all recorded huge gains for the year. None more so than Nvidia, which put an exclamation mark on its historical rally by momentarily eclipsing Microsoft as the largest company in the world by market capitalisation in June. At that time, Nvidia was valued at $US3.4 trillion. To put this into context, that is roughly 10 times the value of Commonwealth Bank, BHP, Woolworths and Telstra combined! The concentrated rally of the magnificent seven was a key theme in international markets during 2023. However, in recent months we have seen the beginning of a rotation where performance is becoming more widespread, rather than highly concentrated in a small handful of companies. This is an interesting development which we continue to watch closely and we think this dynamic could shape international markets over the next 12 months and beyond.

As always, the question begging is where to from here? Markets are a forward-looking beast and the answer hangs on the quality of outcomes against current expectations, impacted by the given starting point. The starting point is elevated with markets near record highs and current expectations are generally for a further fall in inflation leading to interest rate cuts underpinned by broad economic strength. The quality of future outcomes against current expectations is the unknown variable in the equation which will only become evident with time. While we do not have a crystal ball on this matter, it is something we constantly consider. As always, it is our intention to maintain high quality and well diversified portfolios for our clients and a genuinely long-term approach to building and protecting our client’s wealth over time.