Investment Reporting Season Check In – August 2024

The ASX reporting season, held twice a year in February and August, is a critical time for investors as listed companies disclose their latest financial results. This period provides valuable insights into each company’s performance and their outlook for the future.

With the August 2024 reporting season now behind us, we’ve reviewed some notable results to explore what they reveal about the current state of the Australian and global economies.

Commonwealth Bank: Cost of Living Crunch

Commonwealth Bank’s results reflect the ongoing challenges of a high-cost living environment:

- CBA reported a modest 2% decline in net profit after tax to $9.8 billion.

- Loans in arrears by 90+ days have been trending higher but remain broadly in line with long-term averages. Provisioning for bad and doubtful debts rose by 1% compared to the previous year, indicating the bank’s anticipation of tougher times ahead.

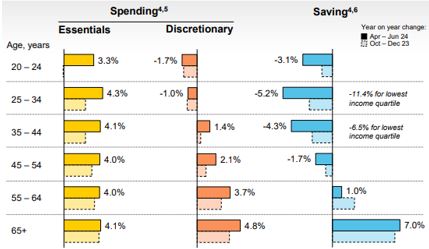

- Consumer spending on essentials has increased, highlighting the impact of rising living costs, but this trend is uneven across demographics. Younger customers are spending less on discretionary items and saving less, primarily due to higher debt levels. In contrast, older customers are spending more on discretionary items and saving more, generally due to higher savings levels.

Source: Commonwealth Bank FY24 Results Presentation, 14 August 2024.

CSL: Vaccine Fatigue Slowing Things Down

CSL reported a substantial 25% increase in net profit after tax, reaching $2.7 billion USD, partly due to the acquisition of Vifor Pharma, a Swiss-based iron deficiency business.

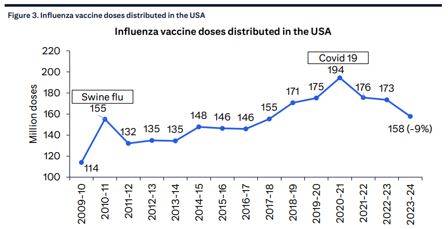

While Behring’s plasma collection is thriving, supported by equipment upgrades, the vaccine part of the business has slowed down. Flu vaccine doses in the US have fallen approximately 25% from their 2021 peak during the height of Covid.

CSL’s Behring division remains the key driver for the business, representing 72% of group revenue. Behring operates plasma collection centers globally and develops, manufactures, and distributes vaccines.

Source: Citi Group Research Report, CSL, 13 August 2024.

James Hardie: Delay in Rate Cuts Impacting Short-Term Volumes

James Hardie has faced challenges due to shifting interest rate expectations:

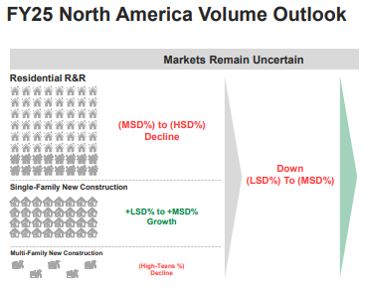

- There has been a notable slowdown in US housing renovation spend due to the impact of lingering higher interest rates. The US is a key market for James Hardie, which was previously expecting a pickup in construction activity, partly due to widely anticipated interest rate cuts in 2024.

- The market now expects 1 or 2 rate cuts in the US by the end of 2024—down from earlier expectations—and rate cut expectations in Australia have been pushed out to 2025.

- The delay in interest rate cut expectations has been one factor in James Hardie’s revised outlook for falling sales volumes. However, this outlook can change quickly if and when the interest rate cycle shifts.

LSD = Low Single Digit, MSD = Mid Single Digit, HSD = High Single Digit

Source: James Hardie Q2 2024 Results Presentation, 13 August 2024.

2024 Summary

The results from the August 2024 reporting season have been mixed. While profits have generally held up well, indicating a relatively healthy consumer base, there are early signs of potential challenges in the economy. Many companies have issued cautious forward guidance, suggesting either a strategy of setting low expectations to overdeliver or genuine concerns about an impending downturn in the economic cycle.

At 360Private, we believe in delivering strong returns throughout the economic cycle by building high-quality, well-diversified, and carefully considered portfolios for our clients. To learn more about how we can assist you with your investment needs, please reach out to our Investment Team at [email protected].