2025 Investment Wrap Up

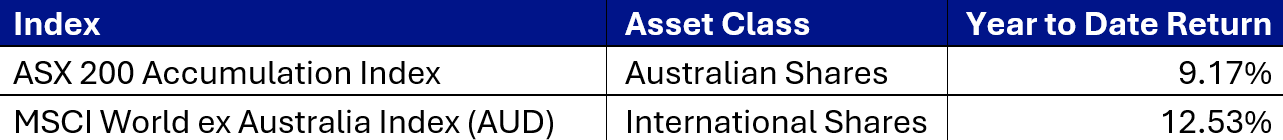

The index returns quoted below are for the period 1 January 2025 to 8 December 2025, sourced from Iress:

At this stage, financial markets are on track to generate an “average” return. Year-to-date returns are currently 9.17% for the Australian share market and 12.53% for international equity markets. However, while the numbers look steady, the journey through 2025 has been anything but average.

A year where the path mattered as much as the result

Markets delivered solid returns overall, but investor sentiment swung sharply at different points through the year. The key lesson for many investors in 2025 is a familiar one: markets rarely move in straight lines, and short-term volatility does not necessarily change long-term outcomes.

The US: volatility, policy expectations, and the AI theme

In the US, the year began with markets focused on political and policy uncertainty. As tariff-related announcements escalated early in the year, markets reacted quickly and risk appetite faded. US equity markets then experienced a sharp pullback through late summer and early autumn before stabilising and recovering as expectations around interest rates and growth evolved.

A key support for US markets has been the view that the Federal Reserve will respond to slowing activity and easing inflation pressures. At the time of writing, markets are heavily focused on the near-term direction of US rates and the possibility of additional easing in coming months.

Alongside the interest-rate narrative, the ongoing investment cycle in artificial intelligence and supporting infrastructure has continued to drive strong performance in parts of the market. While the opportunity is compelling, it has also contributed to concentration risk and increased volatility within certain sectors.

Australia: a sharp drawdown, a strong recovery, and renewed inflation sensitivity

In Australia, market volatility peaked around the period when global tariff concerns were highest. From peak to trough earlier in the year, Australian equities experienced a material decline before recovering as investors reassessed the likely economic impact and the outlook for rates.

On the interest rate front, the Reserve Bank of Australia began easing its policy in early 2025. The cash rate target was then reduced to 4.10% at the February meeting, the first reduction since November 2020.

As the year progressed, inflation results and forward expectations again became central to market pricing. More recently, stronger inflation data has challenged the assumption of rapid rate relief, with market commentary increasingly reflecting “higher-for-longer” risk.

Our portfolio approach for clients

From our perspective, the best approach remains consistent:

- Invest in a portfolio of high-quality assets with diversification across asset classes, geographies and sectors.

- Retain sufficient cash and defensive assets to help manage short-term volatility and take advantage of opportunities when they arise.

- Stay invested for the long-term, maintaining discipline through market cycles.

We believe investors who remain focused on quality, diversification and long-term fundamentals, while making prudent tactical adjustments when appropriate, will be rewarded over time. We will continue to monitor markets closely and make portfolio adjustments where we believe it is in our clients’ best interests.

Important information

This update is general information only and does not consider your personal objectives, financial situation or needs. Before acting on any information, you should consider whether it is appropriate for you and seek advice tailored to your circumstances. Past performance is not a reliable indicator of future performance.